I think we’d all agree that 2020 so far has been a year like no other in our collective memory. The Covid-19 pandemic has tested us all on so many levels, not least the financial. We have witnessed the fastest bear market in history caused by the massive impact of the pandemic on global economies. A long-standing client has always told me “you earn your stripes in a down market” and it is with this in mind that I have perversely found this year particularly interesting.

This summer also marked the fourth birthday of our Dynamic portfolios but before we consider their performance, it would be worth taking a timely look at the process behind the results.

Progeny process

We run three core investment mandates: passive, active and evidence-based. This allows us to be flexible and adaptable to clients’ needs, putting them and their goals at the heart of the process.

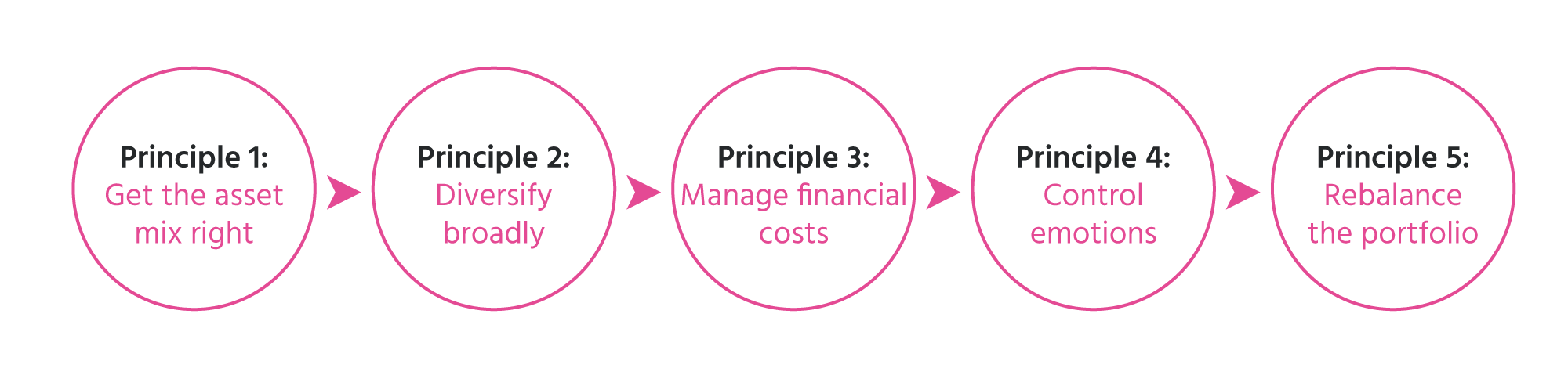

All our portfolio solutions are constructed using a similar philosophy and the same five principles for investing. We make sure the asset mix is right and that the portfolio is broadly diversified to limit exposure to a single asset or risk. We look at the financial costs of the portfolio as well as assessing the emotional side of the investor’s journey. We rebalance model portfolios on a quarterly basis to control risk and keep them at long-term policy targets by reversing deviations resulting from asset class performance differentials.

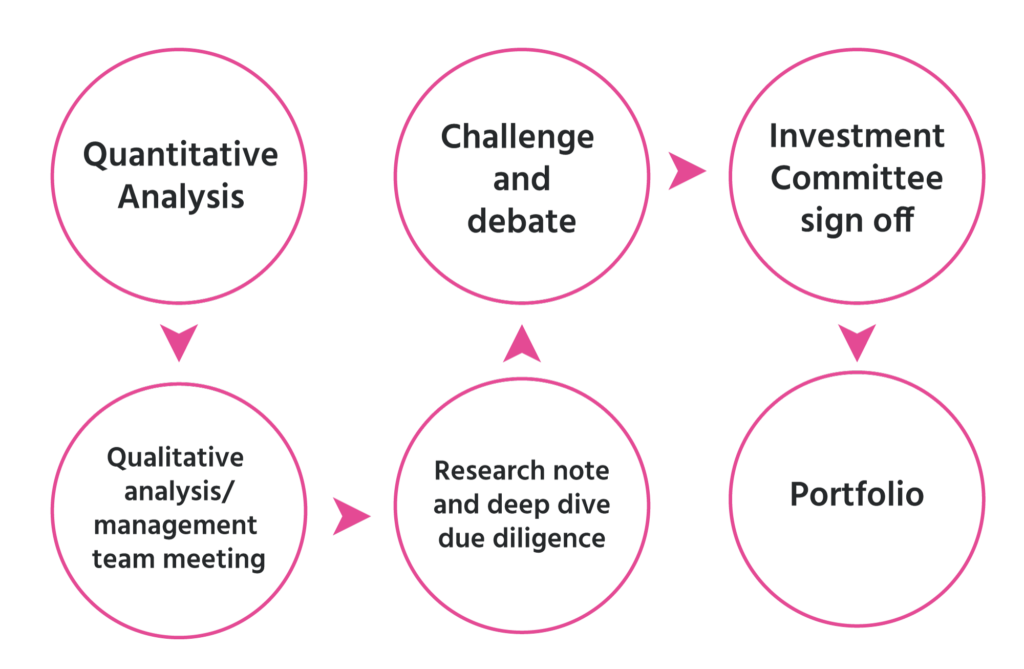

We have formulated a thorough step-by-step system to help fill the asset allocation ‘buckets’. This is mapped to an agreed risk allocation, ensuring clients and advisers know their portfolios sit within their desired risk profile. Here’s a simple flow chart of the steps we take.

We have formulated a thorough step-by-step system to help fill the asset allocation ‘buckets’. This is mapped to an agreed risk allocation, ensuring clients and advisers know their portfolios sit within their desired risk profile. Here’s a simple flow chart of the steps we take.

Our purpose in following this process is to strip out the emotion and tune out the short-term noise. Using a predetermined quantitative process is particularly helpful in achieving this. It also focuses efforts on funds which are suitable for the portfolio and is, in essence, looking for consistency and direction.

Our purpose in following this process is to strip out the emotion and tune out the short-term noise. Using a predetermined quantitative process is particularly helpful in achieving this. It also focuses efforts on funds which are suitable for the portfolio and is, in essence, looking for consistency and direction.

Dynamic portfolio performance

Our Dynamic portfolios are ideal for investors who would like to hand over the day-to-day management of their portfolio to our experts. This works well if they would like to make a lump-sum investment, because it provides the reassurance of a selected portfolio of funds, across a broad spread of assets, at a level of risk that they are comfortable with.

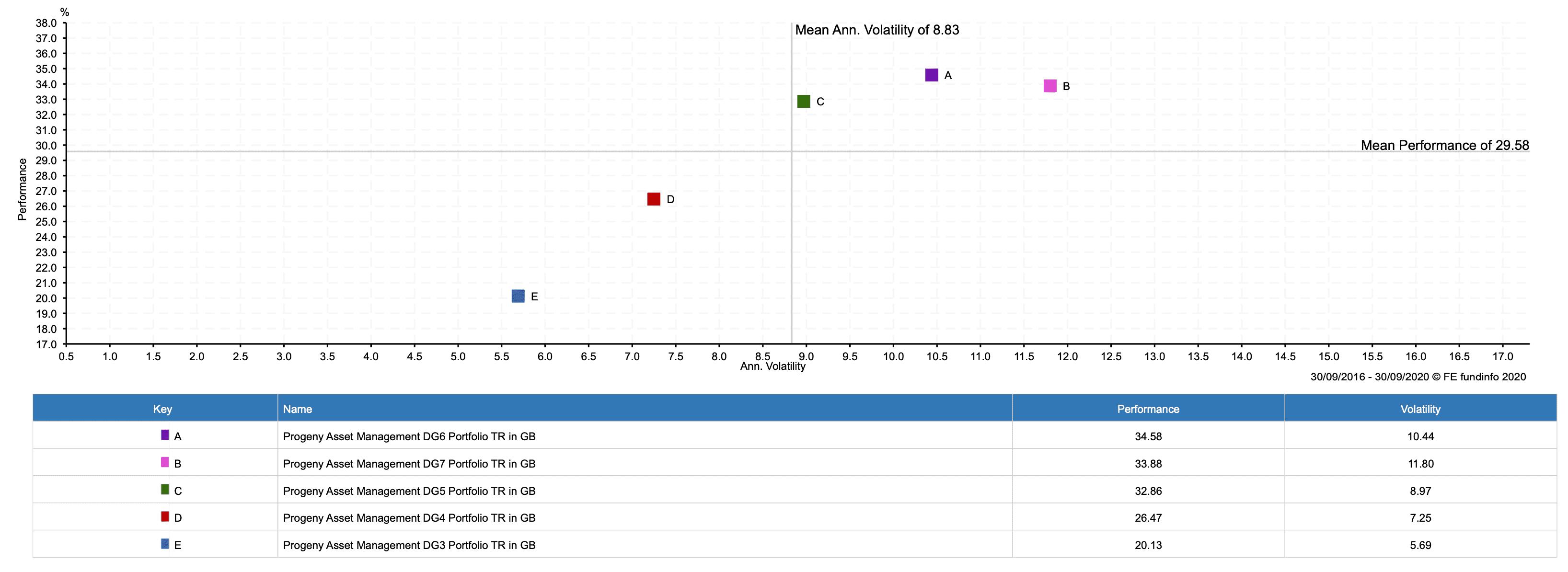

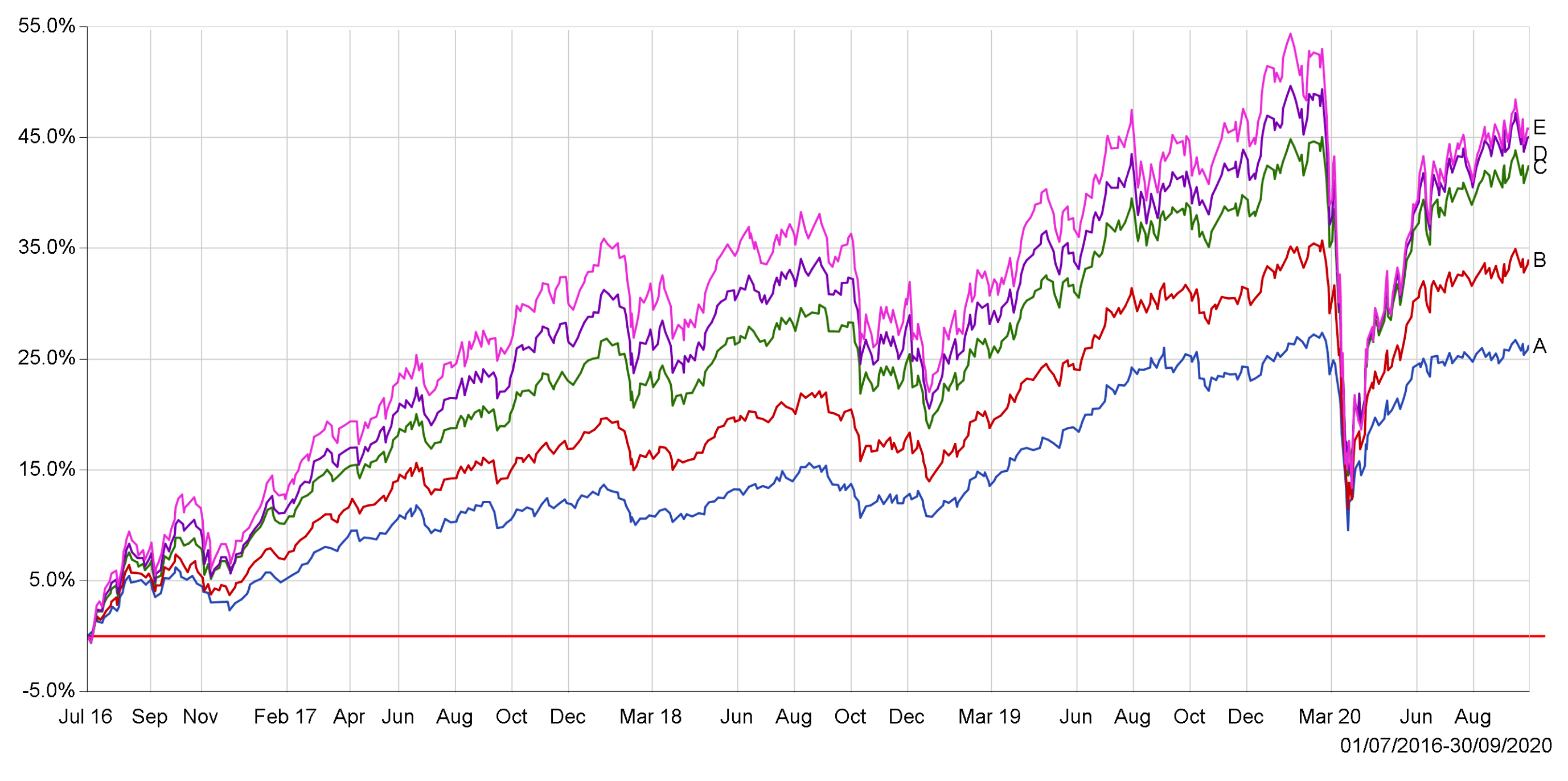

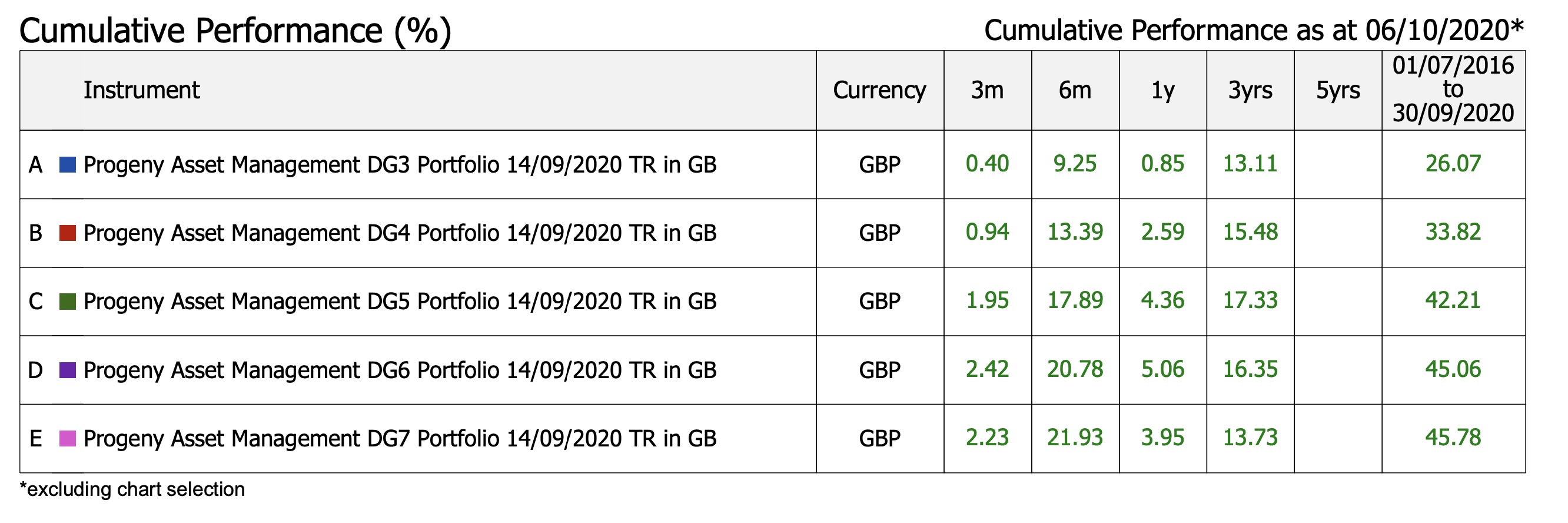

The Dynamic portfolios were launched just seven days after the Brexit referendum, a process which is still yet to truly conclude. Four years on and we have seen snap elections, a Winter General Election, the FAANG Flu of Q4 2018, an oil crisis and, of course, a global pandemic which saw a total liquidity squeeze in fixed interest markets. Our portfolios have navigated recent times and their different market cycles very well and this is reflected in the risk adjusted returns below.

Details of our Dynamic portfolios and all other portfolios can be found on the fact sheets on our website. If you would like to discuss your investment management needs in more detail, please get in touch.

Details of our Dynamic portfolios and all other portfolios can be found on the fact sheets on our website. If you would like to discuss your investment management needs in more detail, please get in touch.