UK Tax Planning Services

We are able to provide a complete range of UK tax services, from one-off specialist advice to ongoing tax compliance, tailored to you.

Our team of international experts are here to help you.

We can support you along your journey by taking a solution-oriented approach and striving to achieve excellence at every turn.

Whether you want us to take away the hassle of completing UK tax returns, you need Inheritance Tax planning advice, or you are looking to sell your business, we can provide tailored advice to help you meet your objectives.

With over 40 years of experience we offer unparalleled expertise and trusted guidance to help you achieve your financial goals confidently and effectively.

We have 22 dedicated offices worldwide providing financial services across the globe, meaning wherever you are, our comprehensive global network ensures seamless access to expert financial services tailored to your needs.

What our tax services can do for you

We offer a complete range of tax services covering both tax compliance and tax advisory. Whether you require assistance with filing a return, structuring your affairs tax-efficiently, minimising tax liabilities or negotiating with HMRC, our tax experts can help.

Useful Guides

Are you looking for tax services that covers both tax compliance and tax advisory?

We like to build long-term relationships with our clients to ensure that we provide them with a service that is specific to their personal circumstances.

Our team has a broad range of expertise and, once we understand a client’s priorities, we can find tailored solutions to help them meet their objectives.

The breadth and depth of our knowledge and experience is also multi-disciplinary. We combine our financial planning knowledge with our tax expertise to arrive at an outcome that is both acceptable to you as a taxpayer and to HMRC as the tax collector. By staying up to date with current legislation and case law we can provide advice tailored to your circumstances.

We provide a fast, efficient tax return service to ensure that you do not have to worry about meeting deadlines. This gives a full understanding of your tax liabilities, so that you can plan ahead, and so that we can provide proactive advice on how you could minimise those liabilities. By having a deep understanding of your family’s circumstances, we can look for opportunities to utilise your own and your family’s allowances and rate bands to maximise your post-tax income.

By working with your financial and legal advisers, we obtain an in-depth knowledge of your circumstances. We can then provide bespoke tax advice, ensuring that your investments are structured in the most tax-efficient manner and that ongoing tax liabilities are managed.

Start your personalised journey

To help you tomorrow, we can help you today

Select the services you’re interested in

Sorry, we couldn’t find any matching services for your search term. Please try again.

Thank you, {{ firstname }}

Please wait whilst we personalise the experience for you.

Frequently Asked Questions

Tax planning involves organising your finances to avoid overpaying taxes. Many people unknowingly pay more than necessary due to a lack of awareness about allowances and legal tax reduction methods. It helps you pinpoint where you’re paying taxes and if you’re overpaying.

The deadline for completing a UK tax return is 31 January each year. If you a liable to complete a tax return and do not do so by this date, HMRC imposes considerable fines for late filing and late payment of tax. The earliest that you can submit your tax return is the first day of the new tax year which is 6 April each year.

Determining if and how much tax you owe on foreign gains and income can be complex and will depend on your UK residency status, and potentially domicile.

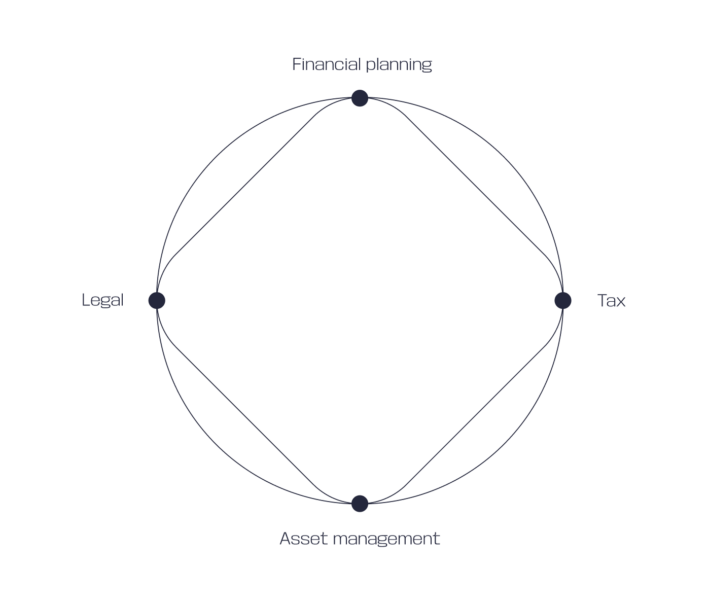

A multi-specialist approach for the richest outcomes

With Progeny’s unique multi-expert approach that brings together financial planning, tax, legal and asset management advice, we’re able to offer you the most comprehensive view of your financial situation.

That’s why our financial planners work closely with our tax, legal and estate planning experts, to offer clients a seamless and truly holistic service.

Whether you are heading towards retirement, looking to reduce your financial obligations or wanting to ensure your wealth is protected for when you are no longer around, we are available whenever you need support.