This blog post is a condensed form of our technical newsletter, which you can read in full here.

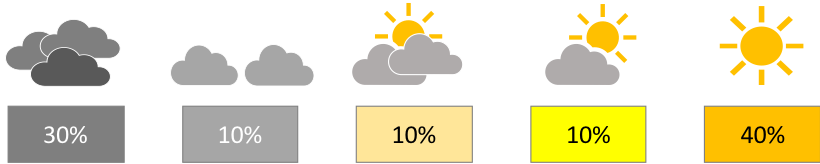

Forecasting ‘expected’ returns on portfolios is a little like forecasting the ‘expected’ weather in the UK. Yet despite sensible generalisations – such as it’s usually sunny and warm in the summer and cold and frosty in the winter – we all know that the day-to-day, month-to-month and even year-to-year variation is high.

Given that it is holiday season, let’s start by taking a look at the weather in Newquay, Cornwall for 1st August each year, to illustrate the point. We know that it is likely that August will be warmer than January, and if we had to describe an ‘average’ day it would probably be mainly sunny, warm, with a gentle breeze and no rain. In reality, a wide variation from our ‘average’ sunny day exists1.

In fact, according to the data, the average day is more likely to be cool, cloudy and windy, with a one-in-four chance of rain but with a lot of variation around this average outcome!

Forecasting the investment weather

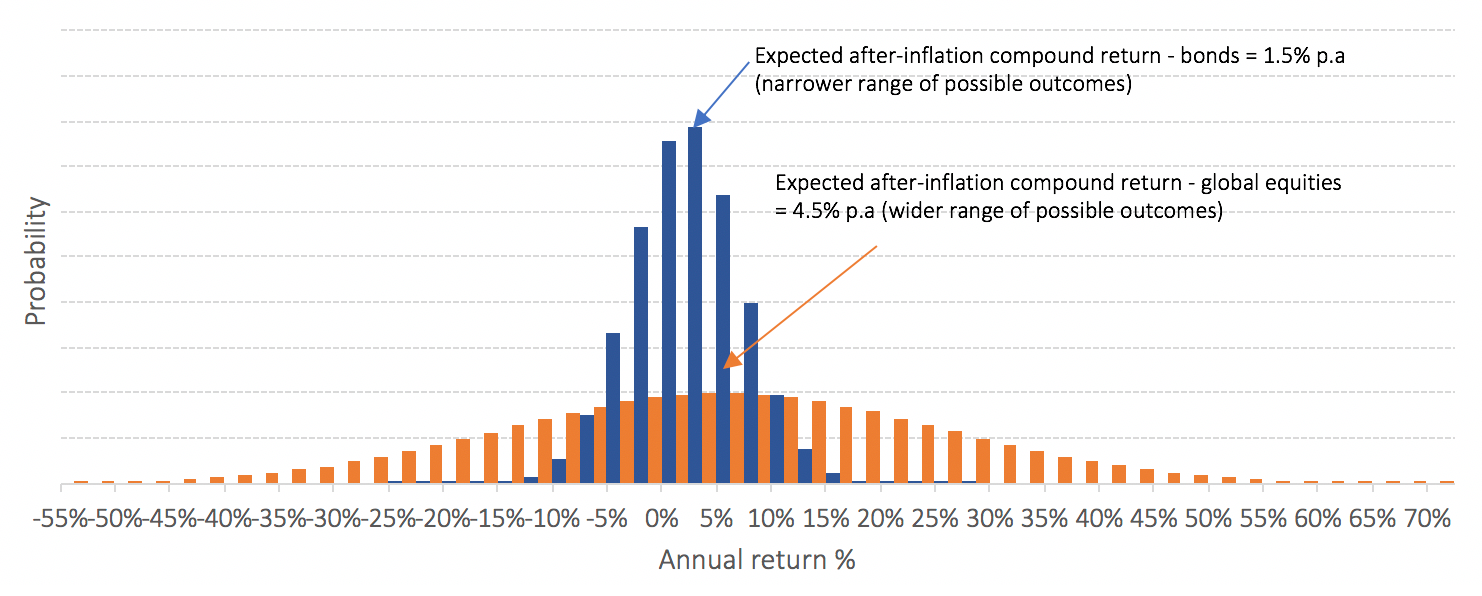

When it comes to making estimates of future asset class returns, it is evident that there is no absolute certainty, only reasonable, informed guesses. Expected returns are not single point estimates of guaranteed returns – absolutely not – as the chart below demonstrates.

You can see that the ‘expected’ return2 sits within a distribution of other possible returns and the range of these potential outcomes is wider for equities than bonds. Summers are hotter than winters. Planning alternative returns scenarios is, therefore, a critical part of building a robust financial plan.

—

Use of Morningstar Direct data (if used): © Morningstar 2018. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

The value of an investment and the income from it may go down as well as up and investors may not get back the amount originally invested.

1 WeatherSpark: Average Weather in August at Newquay Cornwall Airport

2 To be precise the arithmetic return – not the compound or geometric return – sits in the middle of the distribution