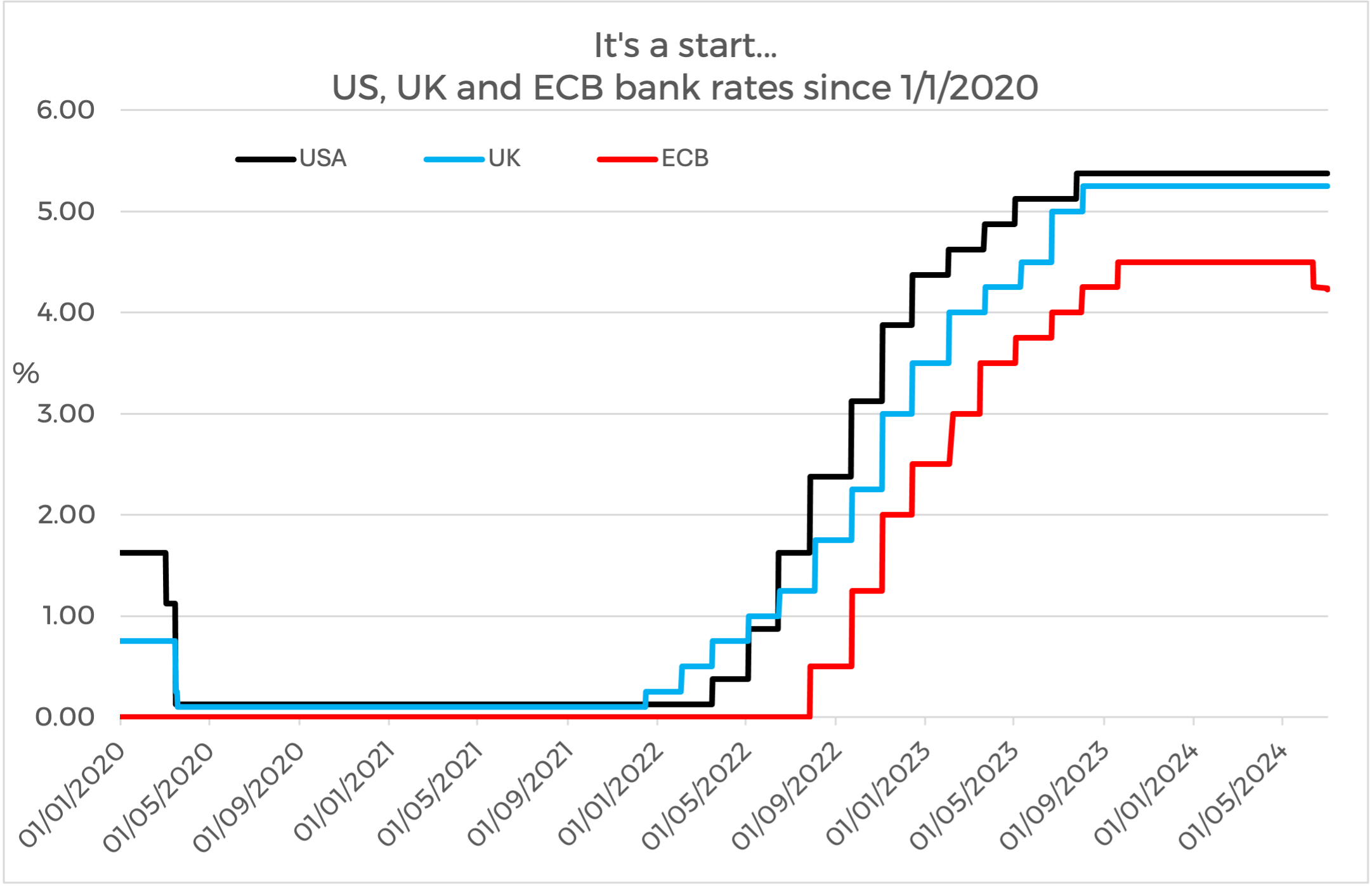

Around the world central banks are starting to cut interest rates, and the European Central Bank is leading the way. In this article we take a look at some of the activity around interest rates over the last few months and highlight how they may impact you.

Source: US Federal Reserve, Bank of England, European Central Bank

The European Central Bank – interest rates

The European Central Bank (ECB) announces an interest rate cut, and it is the first cut since September 2019 where we saw its main rate lowered to a negative -0.5%.

The ECB President Christine Lagarde implied there would be a June cut for some time, so it isn’t a complete surprise. However, she has been more guarded about possible reductions to come. This suggests that her move does not represent the start of regular cuts at each meeting by any means.

The US Federal Reserve (the Fed) – no change mantra

Following this, the US Federal Reserve’s Jerome Powell announced there would be ‘no change’ to interest rates at this time. Using predictions from its members, their rate-setting committee also released their quarterly projection of interest rate falls for the next two years. The elements of this are compiled in what the investment community refer to as the ‘dot plot’. It suggests only one cut of 0.25% in December 2024, and another four in 2025.

The Bank of England – average earnings growth

Just over a week later, the Bank of England led by Andrew Bailey were consistent in this no change mantra. Political influences were denied, and they remained cautious of any interest rate changes close to an election. Average earnings growth of around 6% bring forward a problem for the Bank of England that its counterparts don’t face. Many economists and the Bank of England believe a 6% rise in earnings is incompatible with 2% inflation – which is the target.

Even so, after the Bank’s decision in June, the money markets were pricing in a near-even chance of a cut at the beginning of August. The Bank of England did follow suit and have cut interest rates, bringing them down by 0.25% from its 16-year high to 5%.

When interest rates fall, what does this mean for you?

Bank rates, bond yields and the attractiveness of equities are all impacted by the movements of interest rates.

If you need advice or professional guidance on how this affects you and your investments or just would like to speak to our asset management team, please don’t hesitate to contact us.

Important Note

The information contained within this document is subject to the UK regulatory regime and is therefore primarily targeted at consumers based in the UK.

This article is distributed for educational purposes only. This communication does not constitute financial advice. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult your financial planner to take into account your particular investment objectives, financial situation and individual needs.

The opinions stated in this document are those of the author and do not necessarily represent the view of Progeny and should not be relied upon to make a financial decision.

Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

This email/webpage may contain links to third‑party websites that are not operated or controlled by us. We are not responsible for the content, security, or practices of any third‑party sites. Clicking these links is at your own discretion and risk.

Any links to third party websites provided are for convenience only. We do not control, endorse, or guarantee the content, accuracy, or availability of these external sites. Users access these links at their own risk.

Past performance is no guarantee of future performance.

The value of an investment and the income from it can fall as well as rise and investors may get back less than they invested. Your capital is therefore always at risk. It should be noted that stock market investing is intended for the longer term.