The great American President, Theodore Roosevelt once said, “Risk is like fire: If controlled it will help you; if uncontrolled it will rise up and destroy you.” In the world of investing, we’re very familiar with the age-old battle of risk versus reward. However, instead of being contradictory, like two sides of a coin, investors should consider managing risk as symbiotic. Understanding how risk and reward work together is critical to success.

I’ve often heard people talk about risk and reward as if they have a linear relationship, i.e. the more risk you take, the more reward you’ll get. If this were the case, we’d all be seeking the greatest risks we could find!

Most of us have experienced those “if only I’d known!” moments, when hindsight teaches its lessons. There are many different types of investment risk, some of which are acceptable risks and some of which are unacceptable, so it’s important to understand how these work before parting with any of your hard-earned money.

Here are some examples, to name a few:

Volatility Risk

This is the risk that the value of an investment could rise or fall in the short-term. This risk is typically associated with investments in property or equities. Money saved with a bank or building society does not carry volatility risk because any interest is simply added to the balance and the balance itself cannot fall in value.

Some investments are much more volatile than others, so it’s important to understand the extent to which investments are likely to be volatile when building an investment portfolio.

Inflation Risk

Year after year, prices tend to rise with inflation. This means that a £20 note today will be worth less in the future in purchasing terms.

If inflation was running at 2.5% pa, but money held in a bank was only earning 1.0% pa, the buying power of this money would be reducing every year by approximately 1.5%. So, although money held in a bank may have no volatility risk, it may still be subject to inflation risk. The trouble is, inflation can also be very volatile.

With all this in mind, cash savings can be very suitable for the short-term but it’s also important to strive to outpace inflation with your investment portfolio over the long-term.

Currency Risk

If you invest in foreign currencies, the value of the currency could rise or fall relative to GBP Sterling. This means that if you were to invest in foreign equities that are based in a foreign currency, this adds an extra dimension of risk.

Legislation Risk

There are many different ways to invest, but one thing that’s sure is that legislation will inevitably change, so what may have been a good idea at the time could turn out to be problematic due to a change in legislation in the future.

Leverage Risk

This is one of the most significant yet least understood risks. Leverage risk compounds any risks that are being taken by borrowing money to invest in addition to your initial investment or deposit.

As an example, if you were to invest £10,000 of your savings and raise a further £90,000 of borrowing to buy an asset worth £100,000, you would be exposed to Leverage Risk. If the asset rose by 10%, it would then be worth £110,000, so if you sold the asset and repaid your liability you would walk away with £20,000 (i.e. you would have doubled your initial investment of £10,000 even though the asset only rose by 10%).

Alternatively, if the asset fell by 10% it would then be worth £90,000, so if you needed to sell the asset and repay your liability you would walk away with nothing (i.e. you would see your initial investment of £10,000 disappear even though the asset only fell by 10%). In these examples, the factor of leverage risk is 10x.

In a worst-case scenario, the value of the asset could fall below the outstanding liability (£90,000) and then you would be in negative equity.

Typically, property purchases with a mortgage liability are a good example of leverage risk, but the concept can be applied to many other types of investment and should always be taken into consideration.

Liquidity Risk

Some investments may be quick and easy to buy, but can be very difficult and time-consuming to sell, depending on the timing and market conditions. As an example, it can be a swift process to purchase a property, but finding a suitable buyer with the funds available at the right time can be another matter altogether.

If you needed to sell a property quickly, you may need to consider taking a reduction on the sale price, if you found a suitable buyer at all, so we would deem this investment to have liquidity risk.

Interest-Rate Risk

Interest-Rate Risk is the risk of interest rates changing significantly and causing a negative impact on an investment. For example, if interest rates rose significantly it would be good news for savings but bad news for borrowing, such as mortgages on a Variable Rate.

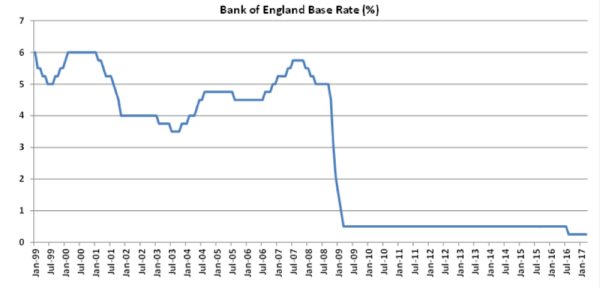

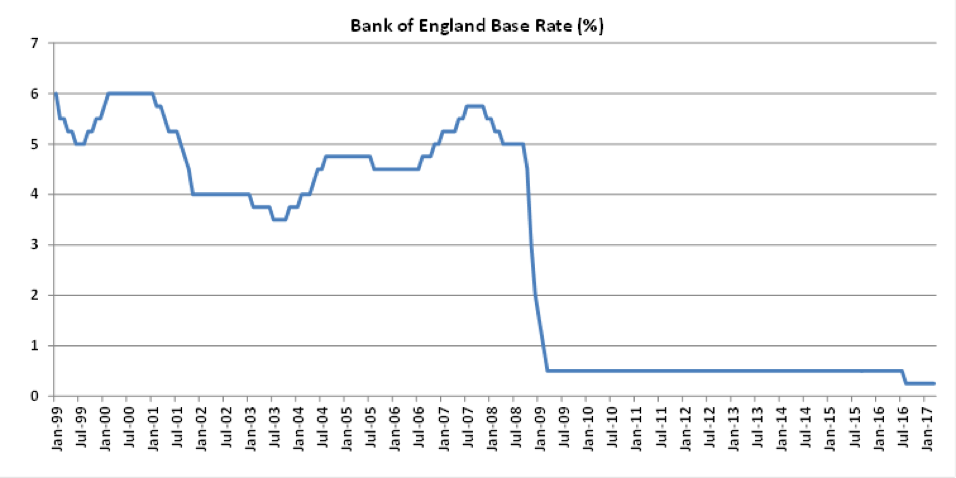

The official Bank of England Base Rate is currently 0.25%. As you can see below, the Base Rate is currently running at record lows and has been for some time now.

Back in November 1979, the Base Rate reached a record-high of 17%! Some of you will remember the impact this had on your outgoings.

How do we manage risk?

The important thing to understand with investing is that you cannot expect a return without some amount of risk. Knowing your own risk tolerance and understanding fully the risks associated with any investment strategy is the key to successful investing.

At Quadrant, we ensure clients invest what’s affordable to them over the long-term, after assessing that they have sufficient income and/or instant-access cash savings to cover their lifestyle expenditure and emergency requirements in the short-term. This provides a capacity to withstand market ups and downs. Secondly, we often recommend that our clients invest in an extremely diverse and global portfolio. Having a well-diversified portfolio spreads exposure to risk. Finally, we determine a suitable asset allocation for each client, which manages the likely level of risk that they are taking. This approach applies to both investments and pensions and it’s not uncommon for clients to adopt different strategies for different goals and timeframes.

You should always seek independent financial advice before taking risks with your money. If you’re unsure about any of the risks you’re taking and would like to review your investments and pensions, please get in touch.

—

This article does not constitute financial advice. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult your financial planner to take into account your particular investment objectives, financial situation and individual needs. Past performance is not a guide to future performance. The value of an investment and the income from it may go down as well as up and investors may not get back the amount originally invested. This document may include forward-looking statements that are based upon our current opinions, expectations and projections.