For investors, it can be easy to feel overwhelmed by the relentless stream of news about investment markets. Being bombarded with data and headlines presented as impactful to your financial well-being can evoke strong emotional responses from even the most experienced investors. Headlines from the ”lost decade”[1] can help illustrate several periods that may have led market participants to question their approach.

- May 1999: Dow Jones Industrial Average Closes Above 11,000 for the First Time

- March 2000: Nasdaq Stock Exchange Index Reaches an All-Time High of 5,048

- April 2000: In Less Than a Month, Nearly a Trillion Dollars of Stock Value Evaporates

- October 2002: Nasdaq Hits a Bear-Market Low of 1,114

- September 2005: Home Prices Post Record Gains

- September 2008: Lehman Files for Bankruptcy, Merrill Is Sold

While these events are now a decade or more behind us, they can still serve as an important reminder for investors today. For many, feelings of elation or despair can accompany headlines like these. We should remember that markets can be volatile and recognise that, in the moment, doing nothing may feel paralysing. Throughout these ups and downs, however, if one had hypothetically invested £10,000 in global developed stocks in May 1999 and stayed invested, that investment would be worth approximately £28,000 today.[2]

When faced with short-term noise, it is easy to lose sight of the potential long-term benefits of staying invested. While no one has a crystal ball, adopting a long-term perspective can help change how investors view market volatility and help them look beyond the headlines.

The value of a trusted financial adviser

Part of being able to avoid giving in to emotion during periods of uncertainty is having an appropriate asset allocation that is aligned with an investor’s willingness and ability to bear risk. It also helps to remember that if returns were guaranteed, you would not expect to earn a premium. Creating a portfolio investors are comfortable with, understanding that uncertainty is a part of investing, and sticking to a plan may ultimately lead to a better investment experience.

While no one has a crystal ball, adopting a long-term perspective can help change how investors view market volatility and help them look beyond the headlines.

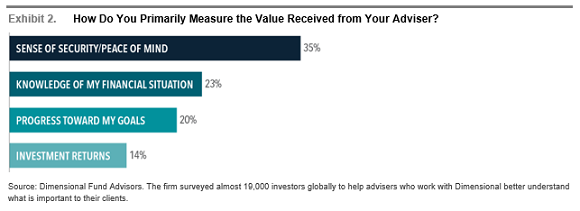

However, as with many aspects of life, we can all benefit from a bit of help in reaching our goals. The best athletes in the world work closely with a coach to increase their odds of winning, and many successful professionals rely on the assistance of a mentor or career coach to help them manage the obstacles that arise during a career. Why? They understand that the wisdom of an experienced professional, combined with the discipline to forge ahead during challenging times, can keep them on the right track. The right financial adviser can play this vital role for an investor. A financial adviser can provide the expertise, perspective, and encouragement to keep you focused on your destination and in your seat when it matters most. A recent survey conducted by Dimensional Fund Advisors found that, along with progress towards their goals, investors place a high value on the sense of security they receive from their relationship with a financial adviser.

Having a strong relationship with an adviser could help you be better prepared to live your life through the ups and downs of the market. That’s the value of discipline, perspective, and calm. That’s the difference the right financial adviser makes.

[1]. For the US stock market, this is generally understood as the period inclusive of 1999 – 2009

[2]. In GBP. As measured by the MSCI World Index (net div), May 1999-April 2018. A hypothetical £10,000 invested on April 30, 1999, and tracking the MSCI World Index (net div), would have grown to £28,033.46 on April 30, 2018. It is not possible to invest directly in an index.

Original Source for this article – Dimensional Fund Advisers