It is never a nice feeling when markets go through periods when they fall; and it certainly does not help to settle the nerves when we see sensationalist headlines like ‘RBS cries “sell everything” as deflationary crisis nears‘ (Daily Telegraph) or ‘Worst start to market year in two decades‘ (FT.com).

To feel unsettled is natural; to panic and sell out of equities is an unreasonable overreaction to the normal workings of the market. Remember that there are many analysts and economists who do not hold these views, but headlines such as ‘Markets might go down or up, or sideways, who knows?‘ are hardly going to make the front pages.

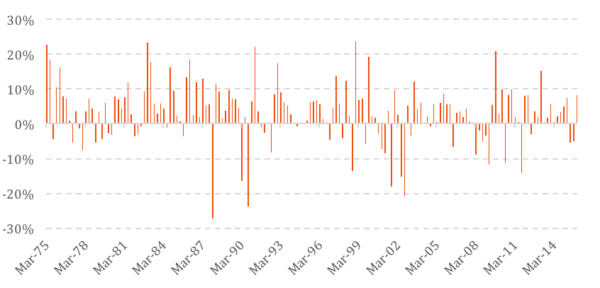

For those who have been around markets for many years, this is just another step – this time backwards – on the bumpy journey. Two steps forward, one step back would not be an unreasonable mantra for stock markets. Take a look at the chart below. It shows the quarterly performance of the MSCI World Index since its inception in 1975. One could hardly say that the returns of the past few weeks have been out of the ordinary.

Looked at another way, using a chart that shows the magnitude of market falls and their recovery, recent market noise is far from unusual. That is the nature of equity investments.

For interest, we looked at the worst months of January in world markets since 1975. As we write, the UK market was down in January by around 7% at the close of business on 18th (although it is up 2% this morning on the back of China’s growth figures of 6.9% for 2015!). Global equities are down around 10% since their high in April last year. The table below reveals that the start to the year has little bearing on the outcome for the year. There is no reason why it should.

| Period | Fall in January | Return for year |

|---|---|---|

| Jan-09 | -9.5% | +30% |

| Jan-90 | -9.0% | -10% |

| Jan-08 | -7.6% | -30% |

| Jan-00 | -6.1% | -6% |

| Jan-03 | -5.0% | +21% |

Source: MSCI World Index (dividends reinvested) in GBP, before inflation

Adopting a binary approach to investing, such as following RBS’s advice to ‘sell out of everything‘, is nonsensical and for long-term investors, entirely inappropriate. No-one knows what is going to happen in the markets. All we know is that over longer time horizons, equities are more likely to deliver higher returns than bonds and cash.

Remember too that any decision to get out of equities also requires another decision to get back in. What happens if you sell equities now and the markets rise from here? If the markets rise, you will have lost out. When would you pull the trigger and get back in? If markets crash, the chances are that you will be too paralysed with fear to get back in and before you know it the market will be up and you will have missed it. Markets tend to move with magnitude and rapidity. There is no-one ringing a bell telling you when to get in or out. Be brave and trust in your robust, diversified portfolio and simply stay invested.

A recent piece of empirical research, which looked at professional money managers who manage multi-asset portfolios owning bonds and equities, revealed the alarming truth that very few (less than 2%) of UK fund managers showed any ability to time when to be in or out of markets successfully. Perhaps not surprising if you believe that markets work. Jack Bogle – the investment legend who founded Vanguard – states:

“Sure, it would be great to get out of the market at the high and back in at the low. But in 55 years in the business, I not only have never met anybody that knew how to do it, I’ve never met anybody who met anybody that knew how to do it.”

Keeping Events In Perspective

There are some important things we encourage you to remember at times like these:

- Markets work pretty well. They absorb all of the information publicly available to investors, in their prices. The news on China is not new and should already be fully reflected in market prices.

- As such, markets go up, down and sideways from time to time, depending upon the release of new information.

- When investing, you do not make a financial loss unless you sell your holdings. As a long-term investor you have the luxury of being able to hold your assets until the storm passes.

- Most investors own a well-diversified balance between bonds and equities and the performance of their high quality bonds will mitigate the effect of equity market falls on their portfolios. Remember, the headline numbers are not your numbers, as you are not 100% invested in the equity markets.

- It is not all doom and gloom; the US and UK economies are still growing strongly. The UK has more people in the workforce than ever before. New car registrations have just reached an all-time high. Petrol is 99p a litre! UK GDP per head is above pre-crash levels.

As we always say, remember that investing is a long-term game that requires patience, discipline, fortitude and time. Stick with the programme and don’t look at the transient value of your portfolio too often, perhaps once a year. As a wise old sage once said:

“Look at your cash everyday if you like, your bonds every three years and your equities every ten years”

We concur.

Please feel free to give us a call if you would like to talk to us about any concerns or comments that you may have.

—

This article does not constitute financial advice. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult your financial planner to take into account your particular investment objectives, financial situation and individual needs. Past performance is not a guide to future performance. The value of an investment and the income from it may go down as well as up and investors may not get back the amount originally invested. This document may include forward-looking statements that are based upon our current opinions, expectations and projections.