At the end of a cold, dark winter, it’s common for our thoughts to turn warmer, sunnier climes. With Covid restrictions easing, many of us are beginning to plan our summer getaways.

Looking further ahead, and thinking longer term, some of us might be planning to emigrate abroad when we retire, to a destination that doesn’t suffer from the predictably bad winter weather and the unpredictably ‘good’ summer weather that we get in the UK.

Until recently, UK citizens had been free to move and relocate within the EU but since Brexit there have been more limited options for living in Europe. In response, there has been an increase in interest in ‘golden visas’.

What are golden visas?

Golden visas – or ‘residence by investment’ – offers the opportunity to buy residency or citizenship in a foreign country in exchange for an investment into the country’s economy.

They offer prospective residents the chance to bypass traditional routes to obtaining residency or citizenship such as the need to settle in the country for a given period, or to pass specified language and culture tests.

Several European countries have golden visa schemes. This includes a number of member states of the EU and the Schengen Area.

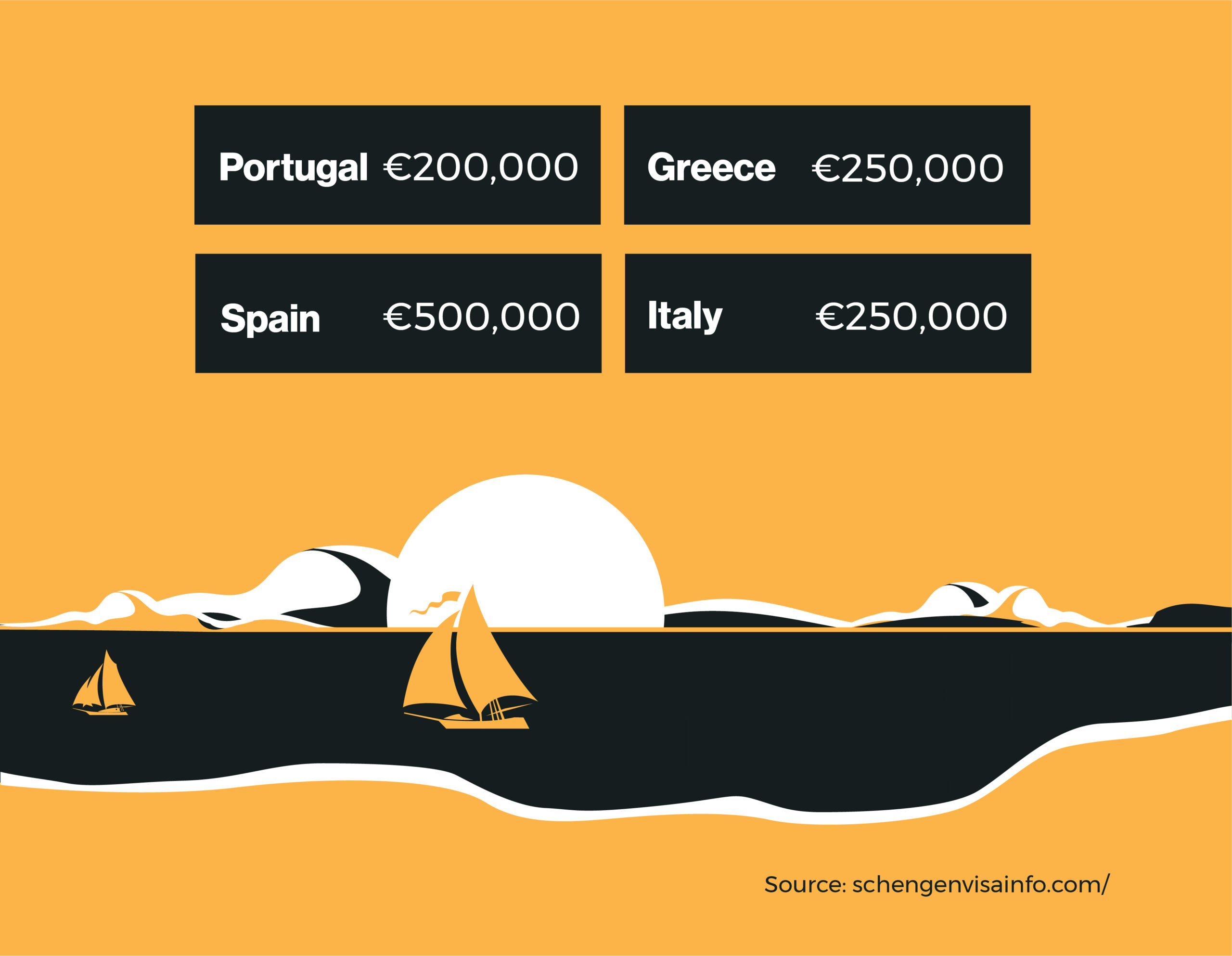

The investments can range from property options to government bonds or investment funds. The amount of money that needs to be invested depends on the state or territory in question. The below graphic shows the minimum investment requirements for a number of EU countries.

Weighing it up

The advantages and disadvantages of the various golden visa schemes can vary depending on what the individual applicant is looking for, as well as the terms of what the countries are offering.

Broadly speaking, the potential benefits tend to speak for themselves, in that they offer residency in countries with an appealing quality of life, either in retirement or before. The southern European countries listed above offer a warmer and drier climate than the UK and in many cases the cost of living may also be lower.

Golden visas are also not just restricted to the EU, with a number of other countries, including Canada, the UAE and Singapore, offering similar schemes.

While there are a number of potential advantages to golden visas, they are not for everyone and anyone wishing to take this route would be advised to do so with full knowledge of what they are committing to and, also, with full visibility of how this would fit with their broader financial and lifestyle aspirations.

For example, some schemes may require an investment in property in the intended destination country, so anyone choosing this option would be well advised to research what is being offered, in terms of the location, price and condition of the property to ascertain whether it represents a sound investment in itself.

Is it well connected? Is it in a desirable area for generating rental income if that is your plan? What are the criteria for selling the property in future? Is the price consistent with market value for equivalent properties in that country/region?

This is just one example but it highlights the importance of conducting thorough research before entering into any golden visa scheme.

Alternative opportunity

Golden visas offer alternative opportunities for gaining residence in a new country that bypass the more traditional routes. However, anyone with an interest in taking this path should study the detail and take professional advice to ensure there are no surprises in the small print. There are many considerations to weigh up and suitability will depend on the individual, the scheme, the investment and the country.

Along with tapping into local expertise at the destination in question, professional advice should be sought, from both a legal representative and a financial adviser, to make sure that any decisions are taken as part of a joined-up, forward-looking financial plan.