The process of due diligence isn’t just a matter of ‘dotting your i’s and crossing your t’s’. Admittedly, it may not appear exciting but the practical business of evaluating asset classes and fund performance is the key driver of success in long-term investing. Through our Investment Committee, we take a great deal of time and care to ensure that our AstutePortfolios are structured to capture the returns on offer in the market. As an investor or potential client you may want to know more about what the Investment Committee has done during the course of the year and how we monitor our funds and portfolio performance.

As retail investors, we are bombarded with market information, much of which is investment spam from product providers promoting the latest trend such as carbon credits, infrastructure funds, gold, student accommodation, etc. All too often these are superficial ideas that lack proper analysis. While we remain open to innovation and certainly keep in touch with research both domestically and globally, our approach is always to evaluate potential and existing assets with strict criteria. This no-nonsense way of review has resulted in a succinct yet very robust set of asset classes. Our criteria include the following:

- Solid return history

- Market-based performance that is not manager dependent

- Transparency of product and liquidity

- Cost effectiveness

- Added value to the portfolio as a whole

Using these primary factors, we regularly examine the efficiency of our portfolios by analysing both the individual fund managers’ performance and the portfolio returns overall. Utilising appropriate indices, we compare this with the theoretical returns that could have been captured. By looking at every constituent part, we are assured that fund managers are keeping to their mandates and that our practices continue to be sound.

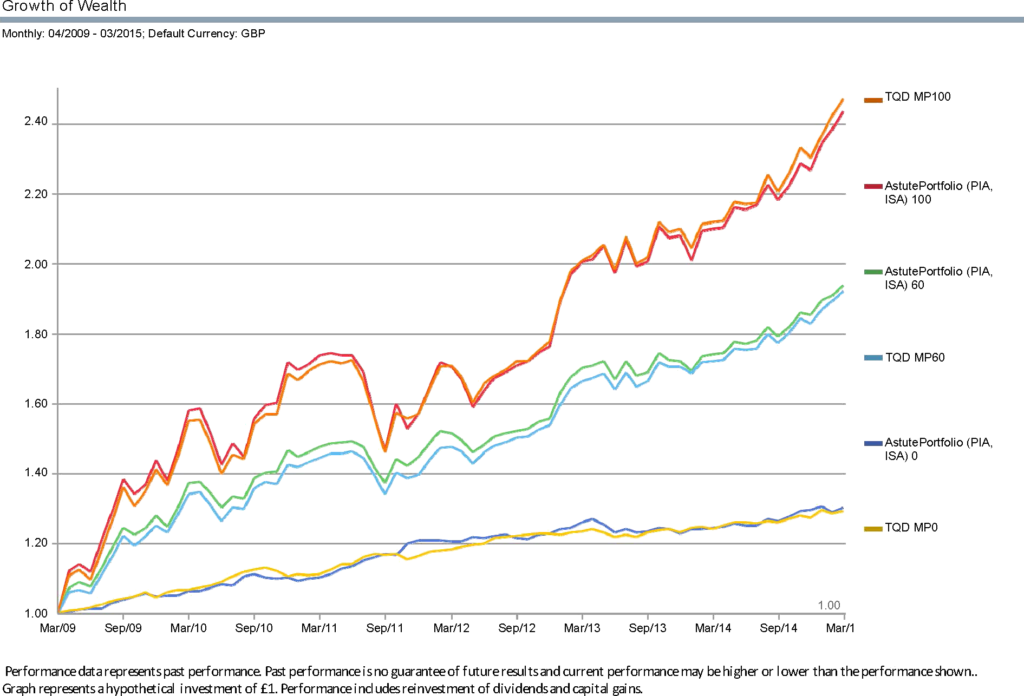

The graph below shows the relationship between historical returns vs. our AstutePortfolios.

The committee reviews statistical information like the chart above to assess the ‘coefficient determination’ – whether or not the relationship between theory and practice is within acceptable tolerance. In simple terms, a measurement of 0.8% is strong; our portfolios consistently achieve between 0.9% and 0.95%. As well as the portfolio behaviour, we undertake a similar statistical review examining the individual equity funds’ behaviour, the results of which have also been excess of 0.9%. These numbers show we have adopted an extremely robust and consistent investment methodology that will deliver the results our clients are expecting.

As well as monitoring the current portfolios, we continue to consider other fund management groups and asset classes to keep abreast of the constantly changing market. We are keen to reduce costs for our clients and keep a close eye on any alternative cheaper fund management groups that can satisfy our strict criteria.

Below are some extracts from the minutes of our Investment Committee meetings from last year. These give a more in-depth picture of our due diligence process that you may find of interest.

February 2014

Dominic Lobo and Andrew Pereira both attended the New Model Adviser two-day conference on Investment Management. Several investment fund management groups were promoting their versions of the smart trackers. These were discussed in the meeting and with the help of research done by Cass Consulting and City of London University in 2013 were found to be inconclusive. There appears to be no compelling evidence to support the hype around smart trackers. The issue of strategic or tactical management was also raised. Quadrant apply the rebalancing strategy, which over a meaningful period of time remains a robust way of balancing the sometimes disproportionate returns of asset classes. It was further confirmed that annual rebalancing is sufficient for client portfolios.

BlackRock’s Global Property Mutual Fund was put on the watch list for Dominic to investigate.

The Governance report issued by Albion was discussed in depth. A substantial part of this discussion focused on revisiting the original asset class assumptions and challenged the composition of the portfolios. The result was a reassuring endorsement of the original structure.

One interesting topic of note was the subject of decumulation, or running out of money in retirement. The Report discussed in some detail the benefits of using a more dynamic approach to income withdrawal, adopting a variable strategy, effectively directing investors to make larger withdrawals in good times. However, in times of poorer returns, reduce income withdrawal. The variability of returns and how they could manifest is a huge factor to the success of a portfolio. Clearly, large withdrawal, initially in tandem with falling fund values, is extremely damaging in the early years. Various scenarios can now be simulated in our life style cash flow planning to show different scenarios.

July 2014

The Dimensional variable credit fund was considered for inclusion within the fixed-interest proportion of the portfolio. Essentially the fund would be managed in terms of risk exposure by Dimensional, between the highest rated credit to BBB (this signifies a high degree of risk) depending on the health of the credit market. The Quadrant proposition stated at the outset that fixed interest element of any portfolio must be solid and that straying into investments in markets where there was a higher likelihood of default should be avoided. The inclusion of several of the PIG (Portugal Ireland and Greece) economies was a worrying aspect, with Greece and Turkey causing us particular concern. On balance this was not a fund that we felt comfortable with investing.

Further evidence generated from the Local Government Pension Schemes publication endorsed that the returns of active managers did not add any value over passive alternatives. Successful active managers rarely repeat. [Read More: Compounding – Why 1% Matters]

October 2014

The Vanguard Short Dated Global Bond Fund was discussed in some length as to whether it should be included in the fixed-interest element of the portfolio. Whilst cheaper, the credit risk exposure was not as robust as the Dimensional fund currently used. The Vanguard fund had only recently been launched and had no track record, although simulated data was examined. The committee concluded that it wanted to continue to invest in the quality end of the short dated bond market.

We discussed the cost reduction announcements of both Fidelity and Vanguard annual management fees on their market trackers. Whilst these AMCs were significantly lower than currently charged by Dimensional, the funds offered by both Fidelity and Vanguard were market-cap-weighted indices and do not imbed any of the Fama French factors that we support. The Dimensional Equity Funds, with their tilts to value and smaller companies should generate 70 basis points over and above market returns. However, Dominic, along with other Dimensional users, is to approach Dimensional to suggest that they should sharpen their pencils on costs.

The BlackRock Global Property Mutual fund tracks the respective property index well and had marginally lower fees compared to the iShares ETF. On closer examination, with BlackRock’s dealers there were dealing spreads of between 25 to 40 basis points on purchases. As we also recommend a rebalancing strategy, the cost of trading within the portfolio overall would outweigh any small benefits of reduced annual management fees. The conclusion was to stay put. The ETF works well enough.

At the meeting, Dominic provided a refresher with regard to the original Fama and French theories. This further reinforced the additional returns captured by adopting the value and smaller company tilts. However there were times of up to three years when these additional returns did not materialise. Following compelling research from the University of Chicago, an additional factor of smarter investing, ‘profitability’, was shown to generate additional returns when applied to stock selection in equity funds. This factor was discussed at length and Dimensional are to adopt this approach within the core portfolios that we use.

April 2015

A full review of market assumptions was again tested, drawing upon new Governance material by Tim Hale at Albion. The conclusion was a resounding endorsement of the existing model.

The benefit of a global perspective when investing was plain to see, as particularly strong returns were captured in International Equity and Global Property Funds. This reflected well in uplifted portfolio values. Dominic stressed that many UK advisers focus much of their energy on UK equities, and that the benefits of diversification, both in terms of safety and capturing additional returns that we offer, are essential.

First Trust Alphadex UK Equity Fund was considered in some depth, as initially from the marketing material, the returns generated seemed excellent. On closer analysis we found the slant towards smaller companies was far greater in the First Trust Funds, which understandably generated far greater return in buoyant markets. However this would also have a far greater downside in times of volatility. The number of stocks that the fund held was small and did not demonstrate the normal level of diversification that we would expect, effectively introducing an element of stock selection and concentration, in which we are sceptical. The First Trust Fund will remain on the watch-list, however, initial impressions were not encouraging. Dominic to investigate further.

Dominic confirmed that after lengthy deliberation, Dimensional have announced that they are to decrease their annual management fees on the core equity funds that we utilise by almost 30%. This will be reflected in portfolio cost reductions straight away. In addition, Jeff Kay was pleased to announce that following his negotiations with Axa Elevate some months before, a further platform charge reduction will follow to our clients in the coming months.

—

This article does not constitute financial advice. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult your financial planner to take into account your particular investment objectives, financial situation and individual needs. Past performance is not a guide to future performance. The value of an investment and the income from it may go down as well as up and investors may not get back the amount originally invested. This document may include forward-looking statements that are based upon our current opinions, expectations and projections.