It may feel like an uncertain time for those looking to buy or sell a property. Mortgage rates had risen to high levels in 2022, and only started decreasing in the summer of 2023. It can be incredibly difficult to predict if the housing market will improve any time soon as interest rates remain high.

To give you a more detailed view of the current housing market, we take a look at the data from major mortgage lenders and the Office for National Statistics (ONS) to determine the impact on buying and selling properties.

Regional differences

Over the past year, the housing market has been a cause of some concern for homeowners and those looking to buy or sell. This has been partly due to the combination of high inflation and soaring mortgage rates.

It is important to note however that the UK housing market has vast regional disparities and there can be differences experienced in the North compared to the Midlands, or the South. For example, Zoopla recently shared figures that showed the East of England suffered a -2.4% decline in house prices in October 2023, whereas Yorkshire and Humber only saw a -0.2% decrease.[1]

On the ESPC House Price Report, the average selling price in Edinburgh and Lothian has decreased annually. We are seeing more fixed price properties appear on the market, whereas in previous years properties would often achieve more than the home report value. Properties in this area are also spending longer on the market taking on average six days longer to sell than this time in 2022.[2]

Property prices according to mortgage lenders

In October 2023, Nationwide reported a yearly fall in house prices with an annual change of -3.3%, despite there being 0.9% of growth for the month.[3]

Halifax saw a slightly higher rise in house prices of 1.1% for the month of October 2023. The average property value according to Halifax was reported to be £281,974[4], but fell over the year by 3.2% – very similar to Nationwide’s recordings.

In November 2023, Nationwide confirmed house prices continued to rise by 0.2% and improved the annual rate of house price growth from -3.3% to -2.0%.[5]

These two leading mortgage lenders rarely come to an agreement on house price growth, as each calculates its house price index using their own mortgage data. These however are just two lenders, what if we look at the data with a wider lens?

Property sales according to The ONS

The Office for National Statistics (ONS) reports on all UK property sales, mortgaged and unmortgaged, which means the database is almost four times the size of Halifax and Nationwide combined. Mortgage lenders will also use prices at mortgage approval stage, whereas the ONS looks at completed sales. The figures in this report do take slightly longer to be collated – for example September data will not emerge until mid-November and won’t be fully revised until December.

At the time of writing, the latest numbers stated by the ONS (August 2023) show a UK house price annual inflation of 0.2%[6].

Inflation and expectation

Source: Nationwide, ONS.

Source: Nationwide, ONS.

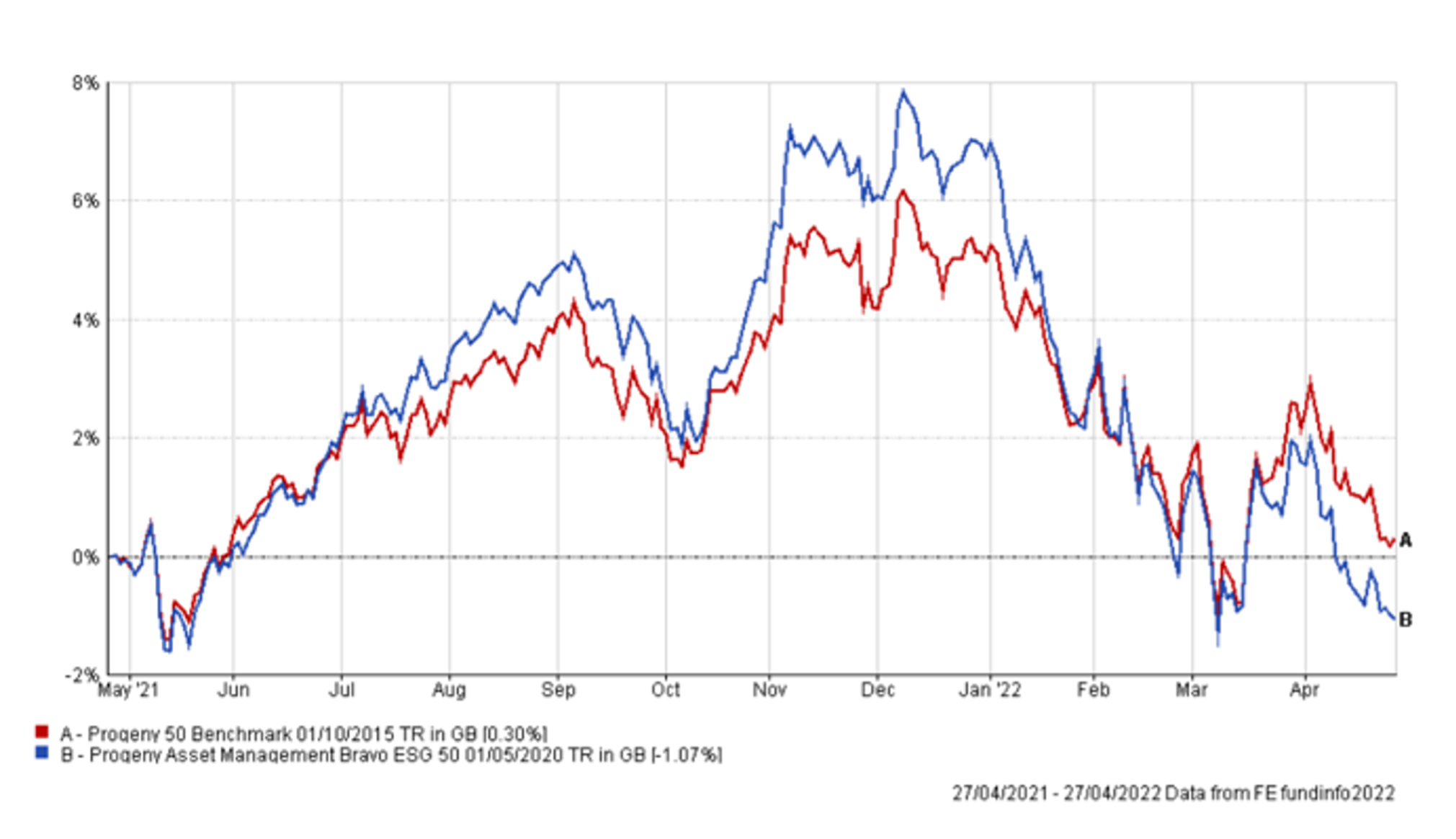

The graph above shows Nationwide’s figures from January 2000 to September 2023. The blue line presents the average house price figure since the millennium. The orange line is an inflation adjusted version of the average house price figures to demonstrate how property prices have really grown in the last 23 years. Due to the recent spike in inflation the final drop for the orange line appears more severe.

It also illustrates a very important fact that isn’t often discussed. The average real house price in 2023 is virtually unchanged from 15 years ago. House prices remain very high compared to the historical data highlighted at the beginning of the graph.

It is also worth noting that compared to the days before Covid, according to this source, Halifax confirmed we are around £40,000 above pre-pandemic levels.[7]

UK housing market – what next?

There are many reasons to buy, sell and move home – the majority of which are personal. If you are currently looking to buy or sell a property you may be wondering if now is a good time, or if it is prudent to wait. The reality is there is never the ‘right time’, there’s only the ‘right time’ for you.

It is important to speak to a professional and do what is right for you and your long-term needs. A Mortgage Adviser can work with you to understand your personal circumstances and give you bespoke, tailored advice.

If you would like to get in touch about your property needs, please do contact our team today.

[1] Zoopla, Where are UK house prices falling in October 2023, Oct 2023

[2] ESPC House Price Report: October 2023

[3] Nationwide Building Society, House prices increase in October, Nov 2023

[4] Halifax house price index 2023, Oct 2023

[5] Nationwide, House price recovery continued in November, Nov 2023

[6] Office of National Statistics, UK House Price Index: August 2023, Aug 2023

[7] Halifax house price index 2023, Oct 2023

Important Note

The information contained within this document is subject to the UK regulatory regime and is therefore primarily targeted at consumers based in the UK.

This article is distributed for educational purposes only and should not be considered financial advice.

If you are unsure about the suitability or otherwise of any product or service, we recommend that you seek professional advice.

The opinions stated in this document are those of the author and do not necessarily represent the view of Progeny and should not be relied upon to make a financial decision.

Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.