Many of us are aware that financial gifts made more than seven years before a donor’s death are potentially exempt from Inheritance Tax (IHT). However, there are certain scenarios when this seven-year rule effectively becomes a 14-year rule. It is important to understand when this situation can arise.

IHT and the Nil Rate Band

Inheritance Tax (IHT) is a tax on the estate (the property, money and possessions) of someone who’s died. There is no Inheritance Tax to pay if the value of your estate is below the £325,000 threshold, or you leave everything above the £325,000 threshold to your spouse, civil partner, or charity.

This £325,000 threshold is called the Nil Rate Band (NRB) up to which you do not pay Inheritance Tax on an estate. Any assets in excess of this amount are taxed at a rate of 40%, unless other allowances and reliefs apply.

Gifting and IHT

Gifts made during your lifetime may reduce the Nil Rate Band that is available to you on your death. There is an annual allowance for gifts of £3,000. Anything exceeding this could be liable for Inheritance Tax unless the individual who has made the gift survives for a further seven years after making the gift, after which point it would not be included in the estate for IHT purposes.

PETs and CLTs

Outright gifts are called Potentially Exempt Transfers (PETs). They are potentially exempt from IHT unless the person who has made the gift dies within seven years of the gift, in which case the transfer will be liable for Inheritance Tax.

Chargeable Lifetime Transfers (CLTs), however, are immediately chargeable to Inheritance Tax and arise when an individual makes a gift into a relevant trust. If someone dies within seven years of making a PET, it becomes a CLT and therefore eligible for IHT, although the amount of tax payable will be subject to tapering. If that person had also made a CLT in the seven years prior to the PET that must be taken into account in calculating the IHT charges which arise following the death.

Order of gifting and impact on Inheritance Tax 14 year rule

In some instances, the order in which a donor makes gifts can affect the amount of Inheritance Tax payable on death. If the person making the gift made a Chargeable Lifetime Transfer before a Potentially Exempt Transfer it may be necessary to look back 14 years before death to assess chargeable gifts.

When the donor dies within seven years of making a gift and a PET becomes a CLT it is necessary to take any other chargeable transfers from the previous seven years into account. In this scenario, a CLT made nearly 14 years before the donor’s death is still within scope for IHT.

Inheritance Tax 14 year rule example

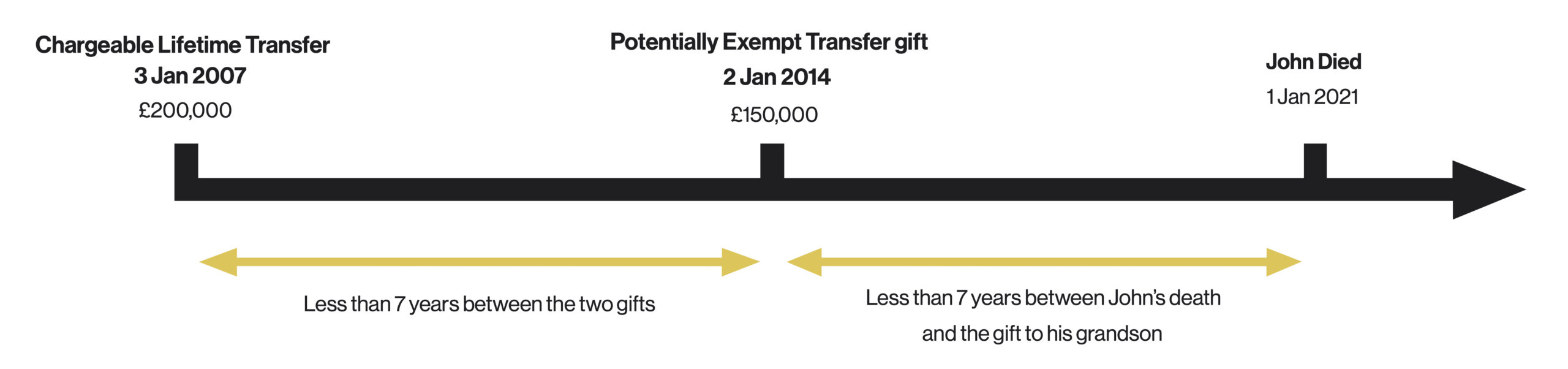

John died on 1 January 2021 having made the following gifts during his lifetime.

- 3 January 2007 he made a Chargeable Lifetime Transfer of £200,000 to a trust

- 2 January 2014 he made a Potentially Exempt Transfer gift of £150,000 to his nephew

The PET made on 2 January 2014 becomes a chargeable transfer because John died within seven years of making it, and it therefore has its own cumulation period. It then becomes necessary to look back seven years from this date to see if any other CLTs were made. The original CLT to the trust falls within this seven-year period as it was made on 3 January 2007.

With a total of £350,000 in CLTs, assuming a Nil Rate Band of £325,000 available for use, this leaves £25,000 of the gift which is eligible for Inheritance Tax, and this tax could have been avoided if the gift to the nephew had been made two days later. This IHT is payable by the nephew. Also, none of the Nil Rate Band will be available to set against the value passing through the Will.

Having your financial and legal advisers working closely on your estate planning can help you to anticipate and plan for this and similar scenarios.

If you would like some assistance with structuring your estate, gifting plans and IHT mitigation, please get in touch.