The number of retirees opting to access their pensions flexibly by using income drawdown has increased significantly in recent years. This can be attributed to a combination of factors, including the introduction of pension freedoms in 2015, declining annuity rates and an increasing State Pension age.

The number of retirees opting to access their pensions flexibly by using income drawdown has increased significantly in recent years. This can be attributed to a combination of factors, including the introduction of pension freedoms in 2015, declining annuity rates and an increasing State Pension age.

Income drawdown is the process of leaving the pension pot invested and drawing a flexible income to suit your requirements. It allows you to have full control over the amount, timing and frequency of the income you take from your pension. This offers flexibility according to your needs, financial circumstances and tax position, which may change over time.

One of the risks of using income drawdown to access your pension pot is that you could outlive your pension. This can happen for several reasons: you live longer than expected; you take an unsustainable level of income; or your investments do not perform as well as you expected.

As such, with income drawdown you need to ensure you generate sufficient investment returns to sustain your income throughout your retirement.

Risk and return

Retirees using drawdown are likely to leave their pension fund invested, with a view to achieving growth in the value of their pot to help maintain their desired income for longer. However, investment returns can be unpredictable and can vary from year to year. Whilst many will focus on the average return they will need throughout retirement to be able to maintain their desired level of income, what is equally as important is the order in which these returns occur, known as the sequence of returns.

Experiencing poor returns in the early years of retirement forces retirees to cash in a larger proportion of their pension for income. This can have a lasting and detrimental effect on the ability to continue generating the same level of income throughout their retirement. This is known as sequencing risk.

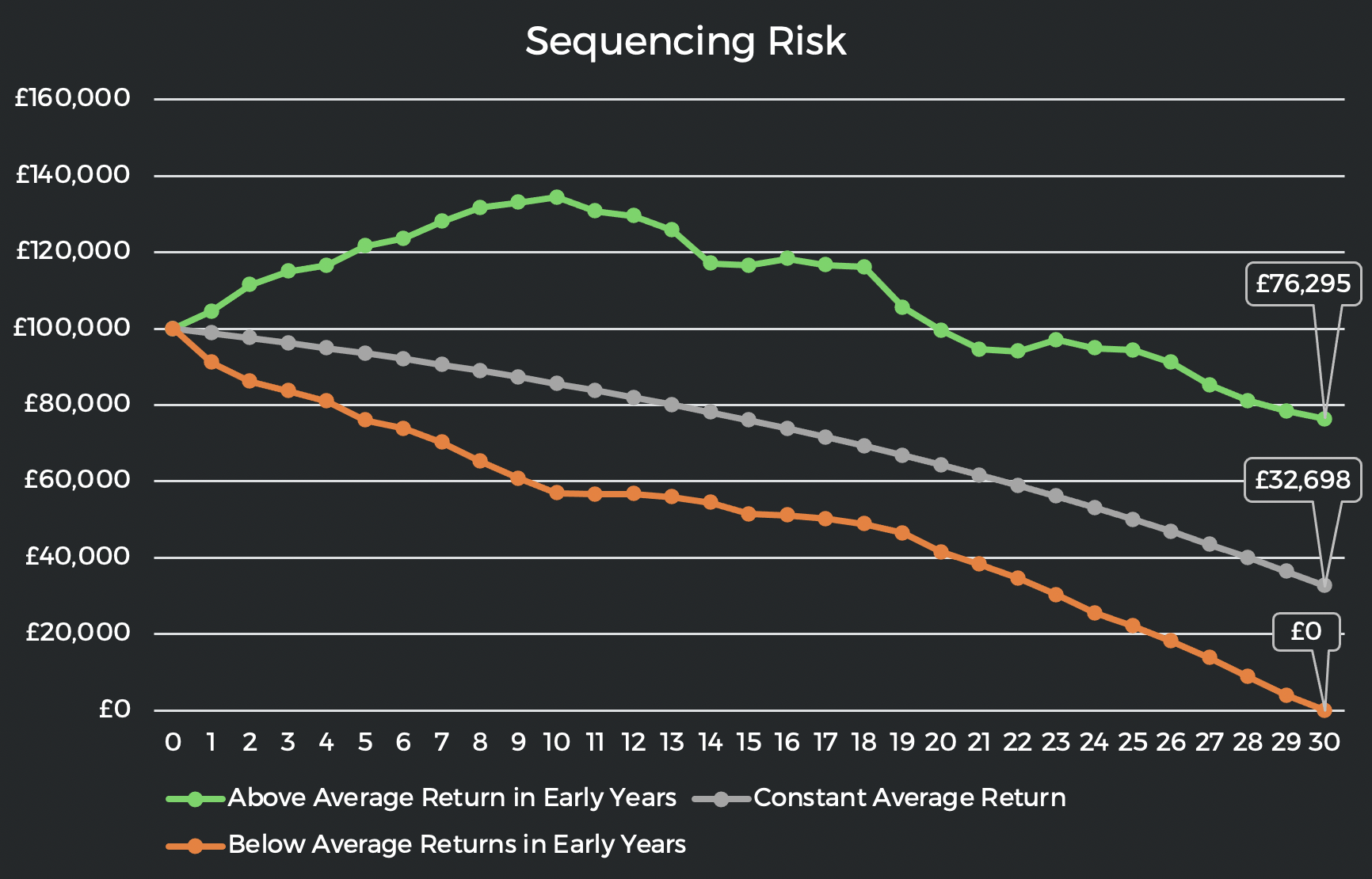

Let’s look at an example. The chart below shows three different scenarios where a retiree starts with a pot of £100,000 and draws an income of £5,000 per year. In each scenario, an average investment return of 4% per annum is projected over the 30-year period.

The difference between the three scenarios is the order, or the sequence, in which the returns are experienced:

- Green – Above average returns are experienced in the early years of retirement.

- Grey – The average return of 4% is experienced every year in retirement.

- Orange – Below average returns are experienced in the early years of retirement.

As you can see, the retiree that achieved below average returns in the early years of retirement ran out of money by the end of the period.

In comparison, the retiree who achieved above average returns in the early years of retirement lasted the full 30 years and even had £76,295 or their original £100,000 remaining.

This is despite the two retirees achieving the same average return over the course of the 30-year period.

What can you do?

Although investment market returns are unpredictable, there are actions you can take to ensure that the order of these returns does not negatively impact your retirement plan.

Keep a cash reserve

Keeping a healthy cash reserve will give you the option to reduce, or stop, the income you draw from your investments during a period of poor performance. Drawing a smaller income from your investments and topping up any shortfall from cash savings will help to reduce the strain on your portfolio during the bad years, allowing the investments time to recover.

Diversify your investments

Ensuring that your investments are appropriately diversified across different asset classes, regions and sectors can reduce the chances of one particular investment causing your portfolio to perform badly. Rebalancing the portfolio periodically can help maintain diversification over time and control the level of risk.

Take a sustainable level of income

Clearly, taking a high level of income from your pot will increase the probability of you running out of money sooner. It will also magnify the impact of sequencing risk when your portfolio does not perform as expected. Taking a sustainable level of income will help to mitigate the risks of this.

Review regularly

The only constant in life is change. Whether this relates to your personal circumstances, investment markets, economic conditions or tax and pension legislation, regularly reviewing your retirement plan with a financial adviser will allow you to be proactive in adapting to change.

You might even want to agree a set of guidelines to adhere to at each review, with the aim of helping to combat sequencing risk. For example, you could decide with your adviser to only increase your income in line with inflation, or to only take any additional lump sum that you wanted in periods when the portfolio has performed well.

Whilst it is important to be aware of how sequencing risk could affect your retirement plans, it is equally important to have protection measures in place to ensure it is not the sole factor in making, or breaking, your retirement income plan.

If you would like some help in understanding how a robust and reliable financial plan can give you the best chance of achieving your retirement goals, please get in touch.